Kureba Amanota y’Ikizami cya Leta yasohowe na Rwanda Education Board (REB) 2022 / Check for National Examinations Results from Rwanda Education Board 2022

FeaturedPopularTop

- Information

- 4 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Announcements

- 627,341 Views

Top Ad

Kureba AMANOTA y’Ikizami cya Leta yasohowe na National Examination and School Inspection Authority (NESA) 2023 / Check for National Examinations RESULTS from National Examination and School Inspection Authority (NESA) 2023

FeaturedPopularTop

- Information

- 4 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Announcements

- 637,862 Views

Top Ad

Kureba AMANOTA y’ibizamini bya Permis Provisoire na Definitif bya Traffic Police (RNP: Rwanda National Police), Rwanda

FeaturedPopularTopBump Up

- Information

- 2 years ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Announcements

- 67,373 Views

Top Ad

Kimironko Gem: Your Perfect Family Home Awaits!

NewFeatured

- Buy / Sell

- 3 days ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- House For Sale

- 116 Views

150,000,000 Fr

Top Ad

Your Dream Starts Here: Prime Kimihurura Plot Awaits!

NewFeatured

- Buy / Sell

- 3 days ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Land For Sale

- 112 Views

78,645,000 Fr

Top Ad

Prime Land Awaits in Kigali’s Bustling Heart

NewFeatured

- Buy / Sell

- 3 days ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Land For Sale

- 112 Views

50,000,000 Fr

Top Ad

Regardez les Résultats des Examens Nationaux du Rwanda Education Board (REB) 2023, Rwanda.

- Information

- 6 days ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Announcements

- 176 Views

Top Ad

Check for National Examinations Results from Rwanda Education Board (REB) 2023, Rwanda.

- Information

- 6 days ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Announcements

- 139 Views

Top Ad

Transport Fiable et Confortable au Rwanda | Compagnie de Transport Professionnelle a Kigali

FeaturedTop

- Business / Service Directory

- 4 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Automotive Services

- 119 Views

Top Ad

Maison avec vue imparable du lac Kivu a vendre a Gisenyi @ 50,000 USD / 50,000,000 Rwf, Rubavu, Rwanda

Featured

- Buy / Sell

- 4 months ago

- Tohoza INFO

- Rubavu, Western Province, Rwanda

- House For Sale

- 374 Views

50,000,000 Frtotal price

Top Ad

Kureba Amanota y’Ikizami cya Leta yasohowe na Rwanda Education Board (REB) 2022 / Check for National Examinations Results from Rwanda Education Board 2022

FeaturedPopularTop

- Information

- 4 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Announcements

- 627,341 Views

Top Ad

Kureba AMANOTA y’Ikizami cya Leta yasohowe na National Examination and School Inspection Authority (NESA) 2023 / Check for National Examinations RESULTS from National Examination and School Inspection Authority (NESA) 2023

FeaturedPopularTop

- Information

- 4 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Announcements

- 637,862 Views

Top Ad

Tubafasha Guhaha Neza mu Mujyi wa Kigali (Quatier Matheus, Commercial na Down Town).

- Business / Service Directory

- 4 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Professional Services

- 113 Views

Top Ad

Explore an Exquisite Range of Women’s Lingerie in Kigali!

Featured

- Business / Service Directory

- 4 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Retail / Wholesale

- 115 Views

Top Ad

Insurance in Rwanda: A Comprehensive Guide to Reliable Insurance Coverage.

- Business / Service Directory

- 5 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Insurance

- 635 Views

Top Ad

Assurance au Rwanda : Guide complet pour souscrire à une assurance fiable.

- Business / Service Directory

- 5 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Insurance

- 641 Views

Top Ad

Découvrez la Sélection Exquise de Lingerie Féminine à Kigali, Rwanda!

FeaturedTop

- Business / Service Directory

- 5 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Retail / Wholesale

- 134 Views

Top Ad

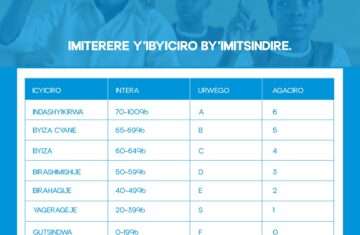

Uko BABARA AMANOTA y’Ikizamini cya Leta asohorwa na National Examination and School Inspection Authority (NESA) 2023

FeaturedTop

- Information

- 7 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Announcements

- 644 Views

Top Ad

Kigali City, Rwanda / Umujyi wa Kigali, Rwanda

- Business / Service Directory

- 8 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Government Services

- 336 Views

Top Ad

YELLOW RWANDA: Making life better for everyday African households by the use of technology to meet basic needs, Kigali, Rwanda

Popular

- Business / Service Directory

- 10 months ago

- Tohoza INFO

- Nyarugenge, Kigali City, Rwanda

- Professional Services

- 3,714 Views

Top Ad

PAST PAPERS S3 2003 – NESA (National Examination and School Inspection Authority) – Inama y’Igihugu Ishinzwe Ibizamini, Rwanda.

- Business / Service Directory

- 10 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- High / Secondary Schools

- 422 Views

Top Ad

PAST PAPERS S6 2003 (General Education) – NESA (National Examination and School Inspection Authority) – Inama y’Igihugu Ishinzwe Ibizamini, Rwanda.

- Business / Service Directory

- 10 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- High / Secondary Schools

- 411 Views

Top Ad

PAST PAPERS P6 2003 – NESA (National Examination and School Inspection Authority) – Inama y’Igihugu Ishinzwe Ibizamini, Rwanda.

- Business / Service Directory

- 10 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Primary Schools

- 384 Views

Top Ad

PAST PAPERS TTC 2002 – NESA (National Examination and School Inspection Authority) – Inama y’Igihugu Ishinzwe Ibizamini, Rwanda.

- Business / Service Directory

- 10 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- Vocational Schools

- 372 Views

Top Ad

PAST PAPERS S3 2002 – NESA (National Examination and School Inspection Authority) – Inama y’Igihugu Ishinzwe Ibizamini, Rwanda.

- Business / Service Directory

- 10 months ago

- Tohoza INFO

- Gasabo, Kigali City, Rwanda

- High / Secondary Schools

- 355 Views

Top Ad